When in2itive does a coding audit for your ASC, the process looks like this:

For the first step of the coding audit, we take 5% of your total cases within a quarter and pull from the schedule at random.

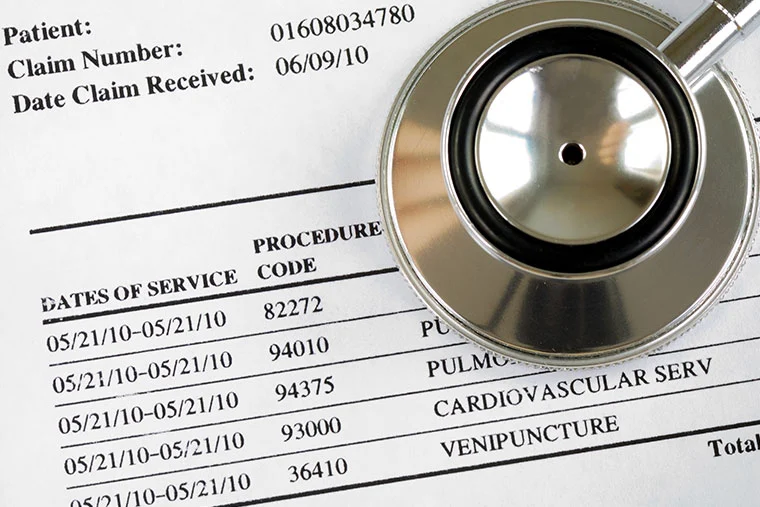

Secondly, our auditor codes all of those cases, compares them against what was coded by the center, and then provides a spreadsheet that includes the coding auditor’s information as well as what was coded.

Lastly, there’s a rebuttal process between the coder and the auditor, where they agree on a percent of accuracy.

After this is completed, an executive summary is provided for your records as well as a conference call to discuss our findings.

The last thing you want is a surgeon working hard performing a procedure and your ASC not being compensated promptly and appropriately. A coding audit can help uncover lost revenue in situations where the care provided is not correctly coded.

in2itive suggests having a coding audit performed when you feel your revenue is down, there’s lost income, there is a possible coding or billing mistake, or something is not right in the billing process. For example, if your cases are up, but your charges are down, this could be an indication that there are some issues with coding.

When something doesn’t seem right but you are unsure, we recommend taking a look immediately by having a small 10-chart sample coding audit completed. This starting point will allow you to further understand what is going on with the revenue of your surgery center and what your next steps should be.